Tracking your expenses is key to building financial stability and improving overall peace of mind. Here are some powerful reasons why it’s beneficial to stay on top of your spending:

1. Reaching Your Financial Goals

By monitoring your spending, you gain a clear picture of where your money is going, which helps you stay on track to meet financial goals. Whether saving for a vacation, your child’s education, or a big purchase, understanding your expenses allows you to allocate funds more wisely. Many are often surprised by how small, daily costs can add up and prevent them from reaching larger savings targets.

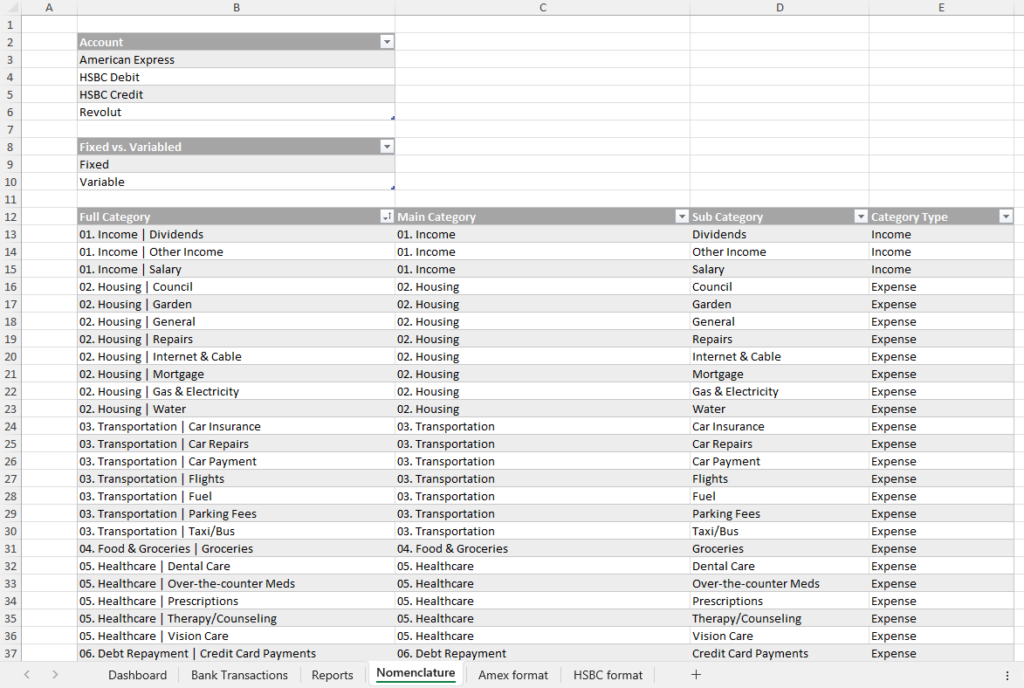

I’ve created a personalized tool in Excel, which I use to track my expenses. Reach out so I can send you the Excel file. Features:

- Comprehensive Dashboard: A user-friendly, visually appealing dashboard that can be filtered by year, month, or any custom selection of months.

- Expenses Sheet: A dedicated sheet to record and categorize all your personal expenses efficiently.

- Nomenclature Sheet: A configuration sheet where users can define categories, subcategories, and other custom labels for their expenses.

- Reports Sheet: An analytical sheet that provides insightful reports to help users better understand their spending patterns.

- Automatic Updates: The dashboard, reports, and filters update automatically when new data is added, ensuring real-time insights without manual intervention.

- Dynamic Year Filter: A smart feature that automatically adjusts reports and visuals based on the selected year, offering flexibility and precision.

- Customisable Views: Users can tailor the tracker to their unique needs, such as adding new categories or adjusting nomenclature settings.

- User-Friendly Interface: Simplified navigation and intuitive design for users of all skill levels, making expense tracking effortless.

Each month I enter the data from all my bank accounts (debit and credit) and then I refresh the Dashboard. I currently monitor the following:

- Expenses per Month

- Expenses per Category

- The Ratio between Expenses/Income/Savings

- Fixed Expenses vs Variable

Measurement is the first step that leads to control and eventually to improvement. If you can’t measure something, you can’t understand it. If you can’t understand it, you can’t control it. If you can’t control it, you can’t improve it.

2. Spotting Fraud Early

Keeping tabs on expenses is an excellent way to catch fraud or identity theft early. Regularly reviewing transactions helps you spot any suspicious or unauthorized charges, allowing you to take swift action to resolve them with your bank and protect your finances.

3. Recognizing Spending Patterns

Tracking your expenses uncovers your spending habits, showing areas where you may be overspending, like eating out or shopping. This insight empowers you to make better financial choices, cut unnecessary costs, and improve your overall financial health.

4. Reducing Financial Anxiety

Money management can often cause stress. Tracking your spending helps you feel more in control of your finances, easing anxiety and allowing you to budget more effectively. This sense of control leads to more thoughtful spending, helping you prioritize what matters most to you.

5. Boosting Financial Knowledge

Regularly reviewing your expenses increases your financial awareness. It equips you with the skills to make informed decisions about budgeting, saving, and investing. This knowledge is crucial for navigating today’s complex financial world and improving your financial well-being.

Effective Ways to Track Expenses

Here are some practical ways to keep track of your spending:

- Manual Tracking: Save receipts and log your purchases in a notebook or spreadsheet.

- Budgeting Apps: Use tools that sync with your bank account to automatically categorize and analyze spending.

- Digital Banking Tools: Many banks provide features that categorize your transactions, offering insights into your spending habits.

By choosing a method that fits your lifestyle, you can start tracking your expenses today and take control of your financial future.

In summary, tracking your expenses isn’t just about maintaining records; it’s about empowering yourself to make smart financial choices that align with your goals and values.