When it comes to managing extra income, one of the most debated financial decisions is whether to pay off a mortgage early or invest.

Understanding Mortgage Payments

A mortgage is essentially a loan taken from a bank to purchase a home, with repayment structured over a long period—typically 30 years. Each monthly mortgage payment consists of:

- Principal – The amount borrowed that needs to be repaid.

- Interest – The cost of borrowing, calculated as a percentage of the remaining balance.

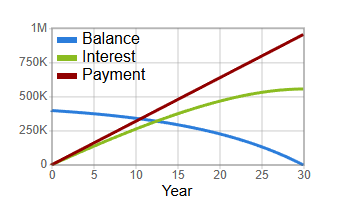

Mortgage payments follow an amortization schedule, which heavily front-loads interest payments. This means that in the early years of the loan, the majority of payments go towards interest rather than reducing the principal.

For example, on a $400,000 mortgage at 7% interest, the monthly payment is approximately $2,660. However, in the first month, only $327 of that payment goes toward the principal, while $2,333 covers interest. Even after 20 years, only 42.75% of the loan is paid off, despite two-thirds of the loan term having elapsed.

This disproportionate distribution of payments means that extra contributions toward the principal can lead to significant savings in interest and an earlier loan payoff.

Comparing Mortgage Payoff vs. Investing

The alternative to paying off a mortgage early is investing. The historical average return of the S&P 500 since 1957 is 10.26% annually, with a realistic post-tax return of 7–8%.

If an individual has a low mortgage interest rate (3–5%), investing in the stock market generally yields a higher return than making extra mortgage payments. However, as interest rates rise above 6%, the decision becomes less clear-cut.

For instance:

- If the mortgage rate is 3%, extra payments effectively yield a 3% return, while investing could provide a 7–8% return.

- If the mortgage rate is 6%, extra payments effectively yield a risk-free, tax-free 6% return, making early repayment more attractive.

Time horizon also plays a significant role. Investing over 25 years at 8% yields $473,000 from an additional $500 per month, whereas paying the same amount towards a 7% mortgage saves $188,000 in interest—a clear advantage for investing over long periods.

Psychological Factors and Benefits of Paying Off a Mortgage Early

While investing may offer higher financial returns, paying off a mortgage early provides psychological benefits, including:

- Peace of mind – Eliminating a major debt reduces financial stress.

- Lower monthly expenses – Without a mortgage, homeowners have more disposable income.

- Increased creditworthiness – A lower debt-to-income ratio can boost credit scores.

- Retirement readiness – A paid-off home ensures housing security in retirement.

Strategies to Pay Off a Mortgage Faster

For those who prefer the security of homeownership over market investments, several strategies can help pay off a mortgage early:

- Bi-Weekly Payments – Instead of 12 monthly payments, making half-payments every two weeks results in 13 total payments per year, accelerating loan repayment by several years.

- Extra Monthly Payments – Allocating an additional $100–$200 per month significantly reduces loan duration and interest costs.

- Lump-Sum Payments – Using tax refunds, bonuses, or windfalls to make one-time principal payments can shave years off the mortgage term.

For example, on a $400,000 mortgage at 7% interest, making bi-weekly payments shortens the loan by 6 years, saving $134,000 in interest.

Conclusion: Which Option is Best for You?

The choice between paying off a mortgage early and investing depends on:

- Mortgage interest rate – Lower rates favor investing; higher rates make early repayment more attractive.

- Investment time horizon – Longer horizons benefit from compound growth, favoring investment.

- Personal financial goals – Those prioritizing wealth accumulation may prefer investing, while risk-averse individuals may value debt freedom.

Ultimately, both strategies have merit, and a blended approach—investing while making occasional extra mortgage payments—might be the optimal strategy for balancing financial growth and security.