The U.S. vs. International Stock Debate

Investors often wonder whether they should diversify their portfolios with international stocks or stick with U.S. equities. The U.S. stock market has significantly outperformed international markets over the past decade, leading many to question if foreign investments are necessary. However, diversification can offer key benefits that many investors overlook.

In this article, I will analyze the pros and cons of owning international stocks and whether they should be a part of your investment strategy.

Why U.S. Stocks Have Outperformed International Markets

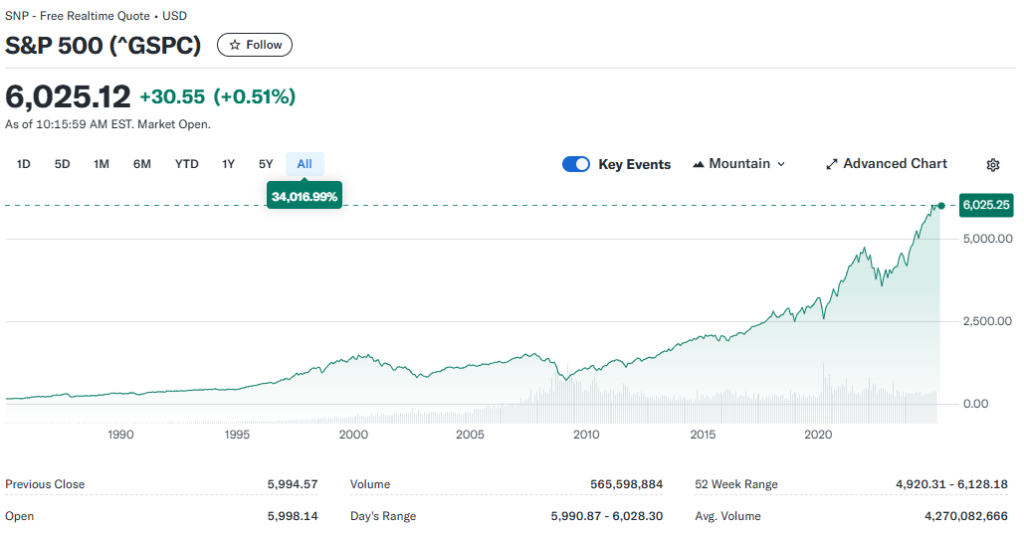

Since the 2009 financial crisis, U.S. stocks have grown roughly tenfold, whereas international stocks have only risen by about 3.6 times. This has resulted in U.S. equities outperforming international stocks by an average of over 9% annually.

With such impressive returns, many investors believe sticking to U.S. stocks is the best option. Moreover, around 29% of the S&P 500’s revenues come from international markets, giving investors indirect global exposure.

But does this mean international stocks are unnecessary? Let’s explore.

The Hidden International Exposure in U.S. Stocks

Some investors argue that because large U.S. companies earn revenue from abroad, they already have enough international exposure. While this is true to some extent, it’s important to understand that a company’s listing location does not fully define its market exposure.

For example, a U.S.-listed company that generates the majority of its revenue overseas is still influenced by global economic conditions, currency fluctuations, and foreign regulations. This indirect exposure, however, is not the same as owning stocks directly from international markets.

Market Cycles: U.S. vs. International Stocks

Stock market dominance shifts over time. Although U.S. stocks have outperformed recently, history suggests that international markets have had periods of stronger returns.

For instance, in past decades, international equities have led in performance, and many experts believe global markets could rebound as economic conditions change. Owning international stocks allows investors to benefit from different growth cycles, reducing over-reliance on the U.S. economy.

The Benefits of Investing in International Stocks

Adding international stocks to your portfolio provides:

- Diversification: Reduces risk by spreading investments across different economies.

- Access to Emerging Markets: Opportunities in fast-growing regions like Asia and Latin America.

- Sector Exposure: Some industries, such as luxury goods (Europe) and manufacturing (Asia), have stronger international presence.

- Currency Diversification: Protection against fluctuations in the U.S. dollar.

Should You Own International Stocks?

The decision to invest in international equities depends on your risk tolerance and investment goals. While U.S. stocks have delivered superior returns recently, global diversification can provide protection during economic downturns and expose investors to different growth opportunities.

Final Thoughts: A Balanced Approach

Instead of an all-or-nothing strategy, consider a balanced approach. Holding a mix of U.S. and international stocks can improve portfolio resilience and enhance long-term returns.

For investors seeking maximum diversification, global index funds and ETFs that include both U.S. and international equities may be a smart choice.